Toll Charges from 1st January 2024

Overview

- Following the application of the relevant CPI inflation figure for August 2022 to August 2023 of 6.3%, the toll rates chargeable across the eight PPP and two TII toll roads on the National Road Network will increase from 1st January 2024.

- The Board of TII approved these increases in tolls for 2024, in October 2023, for Dublin Tunnel and the M50 and confirmed their agreement to increase tolls for eight PPP Toll Concession schemes.

- For M50 and PPP toll roads most car tolls are increasing by 20 cent per journey and heavy good vehicles tolls by 30 to 50 cent per journey.

- Dubin Tunnel toll charges for passenger cars are returning to 2009 levels for peak periods from €10 to €12 to preserve capacity for heavy goods vehicles accessing Dublin Port.

- There are ten toll roads on the National Road Network. Eight are operated under a “Public Private Partnership” (PPP) model and two are operated directly on behalf of Transport Infrastructure Ireland (TII), namely M50-eFLow barrier free toll, and the Dublin Port Tunnel.

- The level of tolls charged on the National Road Network is regulated through an inflation (CPI) adjustment mechanism as set out in the Toll Bye-Laws, which means tolls cannot go above inflationary impact, thus the terminology of “Maximum Allowable Toll”. The charts below show the toll increase per vehicle class and toll scheme / road.

- The Bye Laws outline the calculation method for toll rates. The Bye Laws also contain provisions to prevent toll operators from charging toll rates which are higher than a specific level of inflation which is defined as a ‘maximum toll’ for each vehicle class.

- The revenues collected on the TII operated toll schemes (i.e. M50 and Dublin Tunnel) are expected to contribute about 45% of the funds to TII’s Protection and Renewal budget for 2023.

- The tolling income collected by TII is combined with Exchequer grant allocations and used for works associated with the operation, renewal, and improvement of the National Road network. The Protection and Renewal (PnR) Exchequer grant allocation for 2023 is €254 million and this is supplemented with tolling income expected to be in the range of €208 million for the full year.

- The Exchequer grant for 2024 is not expected to increase (i.e. it will remain at €254 million) while the tolling income is expected to increase to approximately €240 million, which in effect will mean that operations, renewal and improvement activities are therefore almost evenly funded by equal amounts of toll income and Exchequer funding.

Summary on purpose of tolls and what tolling income is used for:

TII’s duty is to secure the provision of a safe and efficient network of national roads and while the primary purpose of toll revenue is generally to fund ‘protection and renewal’ activities on the National Road Network, there are some notable differences between the PPP schemes, and the M50 toll scheme and the Dublin Tunnel toll scheme, as noted in the sections below.

The revenues collected on the TII operated toll schemes (i.e. M50 and Dublin Tunnel) are expected to contribute about 45% of the funds to TII’s Protection and Renewal budget for 2023.

This Protection & Renewal budget is an important element of TII’s annual budget, and it is developed with and approved by the Department of Transport. In summary, the expected tolling income from the M50 and Dublin Tunnel tolls for the coming year is combined with a separate capital allocation from the Exchequer to make a total Protection & Renewal budget.

In 2023, the expected tolling income of approximately €208 million will make up about 45% of the overall Protection & Renewal budget for the national roads programme.

The €208 million tolling income contributes to fund:

- M50 Motorway Operations & Maintenance

- Motorway Maintenance and Renewal Contracts

- Tolling Operations

- Tunnel Operations

- Tunnel Renewal

- Various asset management and maintenance schemes; and

- Various road safety and improvement schemes.

TII will use the expected increase in income in 2024 to continue to fund the Protection and Renewal activities where significant increases in costs are being experienced due to inflation. This is important as the Exchequer funding for this budget area will not increase to keep pace with inflation.

- The Bye Laws exempting certain vehicles: Goods vehicles above 3.5 tonnes (gross vehicle weight) and large buses and coaches are not required to pay tolls; and

- The Bye Laws require non-exempt vehicles (e.g. passenger cars) to pay different charges for ‘peak’ and ‘off-peak’ periods.

- There have been significant increases in traffic volumes, particularly tollable traffic (Cars/LGVs) which increased from Jan-Aug 2019 to Jan-Aug 2023 by 17%.

- The decision to increase the Dublin Tunnel toll charges was made with the primary purpose of continuing to preserve the capacity for HGVs using the tunnel to access Dublin Port, and a secondary purpose of collecting toll income to fund TII’s protection and renewal activities.

- In relation to the PPP programme it should be noted that the revenue collected by the respective Toll Companies is also used to pay off loans borrowed by the PPP companies for the construction of the motorway, as well as for the operation and maintenance of the motorway. The terms for these loans are generally long term and can range up to 20 or 25 years.

- It is important to note that increasing the tolls in relation to the PPP toll roads (subject to the limits specified in the Bye Laws and set out below) is primarily a matter for the PPP companies and their funders and TII are not entitled to interfere in this process.

Details on Toll Calculations for 2024

- M50 Toll Road

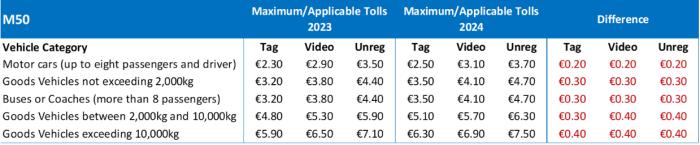

CPI increased by 6.3% between August 2022 and August 2023 and this increase has resulted in an increase in the tolls chargeable for users of the M50 as set out in Table 1.

VAT is not applicable to the M50 Tolls.

The Bye-Laws for the M50 provide that:

“For each Toll Year and for each class of User/Vehicles the Maximum Tolls … shall be the Base Tolls for such class of User/Vehicles....... “….in each case, multiplied by the Consumer Price Index for August in the previous year (using a December 2006 base year of one hundred (100)), divided by the Opening Index, and the resulting amount (together with any applicable value added tax, if any) shall be rounded upwards or downwards, as the case may be, to the nearest ten cent (10c) or such other amount (equal to or less than fifty cent (€0.50)), in each case, as may be determined by the Authority.”

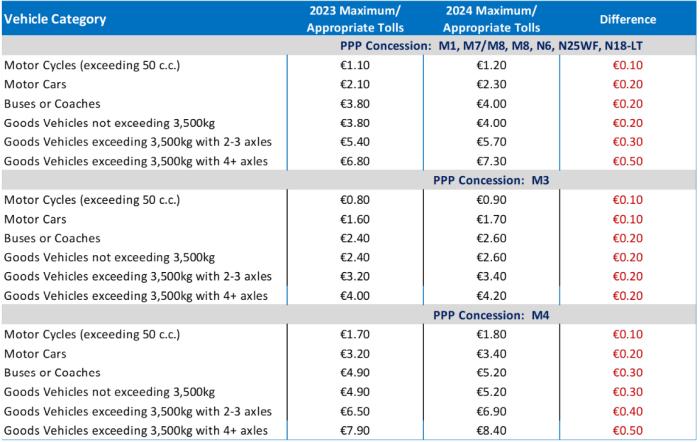

- Public Private Toll Concessionaires (PPP): Eight PPP toll concessionaires throughout country.

The PPP companies have submitted their toll charge calculations as part of their Annual Toll Plans. TII have reviewed these submissions and concur that the proposed 2024 toll charges calculated are within the limits prescribed by the Toll Bye-Laws. Table 2 sets out the calculated 2024 toll charges for the 8 PPP toll concession schemes. The toll charges include VAT @23%. The CPI increased by 6.3% between August 2022 and August 2023 and this has resulted in increased tolls for all vehicle categories on all toll concession roads.

The Bye-Laws for the different PPP toll roads (or concessions) typically provide that:

The Maximum Tolls for each Toll Year shall be the aggregate of:

(a) The Base Tolls multiplied by the Consumer Price Index for August in the previous year, on a [November 1996 base year of 100], divided by the Opening Index, and

(b) VAT at the prevailing rate on the amount derived pursuant to subparagraph (a) and the resulting amount shall be rounded to the nearest 10 cent.”

The Appropriate Tolls are the tolls chargeable by the Toll Company as agreed with the NRA (inclusive of indexation, VAT and rounding) provided that such Appropriate Tolls shall not exceed the Maximum Tolls.

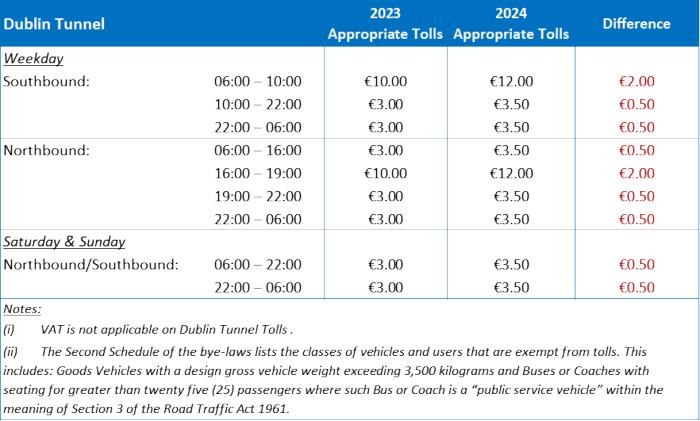

- Dublin Tunnel

The tolling arrangements at the Dublin Tunnel are intended to manage demand at peak times and ensure that HGV movements to and from Dublin Port are not impeded with additional traffic and congestion.

As set out above, given increased levels of traffic using Dublin Tunnel, in particular an increase of 17% in tollable traffic (Cars/LGVs) since 2019, TII is increasing tolls at peak hours from €10 to €12 and off-peak from €3 to €3.50.

More detail on financials

- TII toll income is reported annually within TII’s Annual Report and Financial Statements which identifies income generated from the M50 Toll and Dublin Tunnel, as well as any additional revenue from the PPP toll roads (termed ‘revenue share’) under the terms of the PPP contracts.

- TII’s financial statements are audited annually by the Office of the Comptroller and Auditor General and laid before the Houses of the Oireachtas.

- The PPP toll companies are required under law to file their annual accounts each year with the Companies Registration Office (CRO) in Ireland.

- Full information relating to the Bye Laws supporting TII toll schemes is available at TII Statutory Notices